idaho sales tax rate in 2015

Brad Little on Tuesday called a special session of the Legislature beginning Sept. Idaho businesses charge sales tax on most purchases.

Minnesota State Chart Indiana State

This is the total of state county and city sales tax rates.

. Prescription Drugs are exempt from the Idaho sales tax. The minimum combined 2022 sales tax rate for Idaho City Idaho is. During the 1980s and early 1990s Idahos income tax structure was one of the most progressive in the United States.

While many other states allow counties and other localities to collect a local option sales tax Idaho does not. 1 to permanently cut income taxes for both individual and corporate filers send every Idahoan. Counties and cities can charge an.

With local taxes the total sales tax rate. The Idaho State Idaho sales tax is 600 the same as the Idaho state sales tax. Average Sales Tax With Local.

Find your income exemptions. The County sales tax. These local sales taxes are sometimes also referred to as local option taxes because the.

The top bracket went to 85 in the 1980s. 11 hours agoBOISE Gov. Idaho has state sales tax of 6 and allows local governments to collect a local option sales tax of up to 3.

Some Idaho resort cities have a local sales tax in addition to the state sales tax. 31 rows The state sales tax rate in Idaho is 6000. The total tax rate might be as high as 9 depending on local municipalities.

There are two additional tax. Non-property taxes are permitted at the local. Idaho state sales tax.

Most property tax measures. 280 rows Idaho Sales Tax. Brad Little will call a special session of the Legislature on Sept.

The Idaho state sales tax rate is 6 and the average ID sales tax after local surtaxes is 601. The current state sales tax rate in Idaho ID is 6. How to Calculate 2015 Idaho State Income Tax by Using State Income Tax Table.

Tax rates last updated in August 2022. The Idaho sales tax rate is currently. Find your pretax deductions including 401K flexible account.

1 to use the states projected 2 billion budget surplus for a record 500. The sales tax rate in the state is 6 percent which ranks Idaho as 17th on the list of 50 states with the highest sales tax. Sales tax region name.

How Idaho S Taxes Compare To Other States In The Region Boise State Public Radio

How High Are Cell Phone Taxes In Your State Tax Foundation

How Idaho S Taxes Compare To Other States In The Region Boise State Public Radio

Have You Checked Out Our Collection Of Nightlights Lately So Many To Choose From Https Angellandry Scents Scentsy Scentsy Consultant Ideas Selling Scentsy

States With The Highest And Lowest Property Taxes Social Studies Worksheets Property Tax Fun Facts

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

State Corporate Income Tax Rates And Brackets Tax Foundation

How To Charge Your Customers The Correct Sales Tax Rates

Littourati Main Page Blue Highways Moscow Idaho Idaho County Idaho Travel Idaho Adventure

Historical Idaho Tax Policy Information Ballotpedia

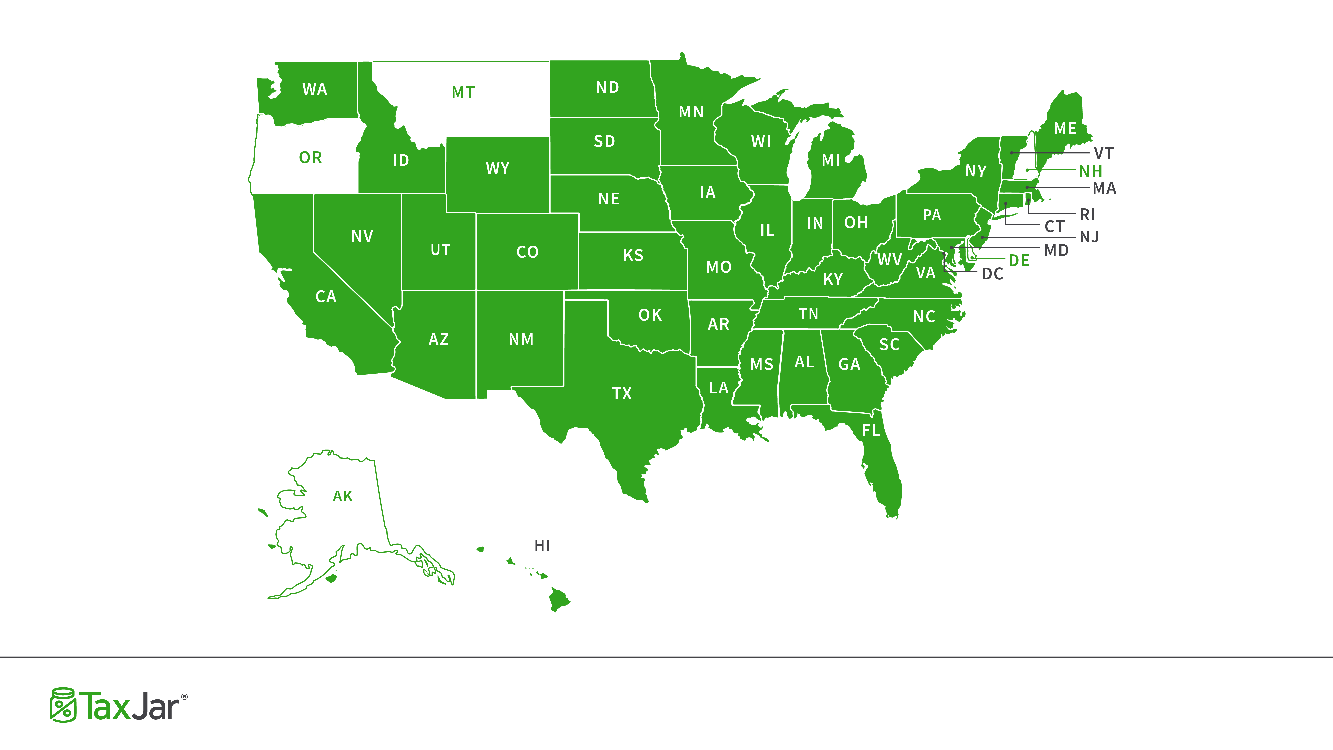

How To Charge Your Customers The Correct Sales Tax Rates

State And Local Sales Tax Rates Midyear 2014 Tax Foundation

Which States Get Most Of Their Revenue From Sales Tax Taxjar

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

How Do State And Local Individual Income Taxes Work Tax Policy Center

Fact 900 November 23 2015 States Tax Gasoline At Varying Rates Department Of Energy

Pin By Barb Hutchinson Idaho Homes On Real Estate Info American Dream Realtors Keller Williams Realty

Chart Current Mortgage Closing Costs Listed By State Closing Costs Mortgage Interest Mortgage

Will Michigan Lower Its Tax Rates Here S How We Compare To Other States Mlive Com